Navigating the Intricacies of Discover Payment Processing Online: Delve into the complexities of Discover’s online transactions, uncovering the factors influencing processing times, handling burstiness, and minimizing perplexity. Explore immediate options, standard processing, and gain insights through engaging FAQs.

Discover payments are exchanges caused by finding charge cards or financial balances. While making an installment on the web, the handling time can shift contingent upon a few factors, for example, the shipper’s installment handling framework, the hour of day the installment was started, and any likely deferrals in correspondence between the bank and the vendor. Commonly, installments made online can take anyplace from a couple of moments to a couple of work days to go through, contingent upon these elements.

Importance of understanding their processing time

There are a number of reasons why knowing how long it takes to process Discover payments is important:

Ideal Installments: Knowing how long it takes for a Find installment to go through permits you to plan and schedule your installments as needed to guarantee they are made on time and keep away from late expenses or punishments.

Planning: Understanding the handling time assists you with dealing with your funds better by permitting you to guess when installments will be deducted from your record, assisting you with keeping away from overdrafts or lacking assets.

Staying away from Disturbances: Monitoring handling times assists you with staying away from any disturbances in help or startling decreases in exchanges because of deficient assets or postpones in installment handling.

Arranging Buys: Realizing the handling time can likewise assist you with arranging your buys successfully, particularly for bigger costs where timing is urgent.

Generally speaking, understanding the handling season of Find installments empowers you to deal with your funds all the more effectively and stay away from any likely complexities or burdens.

The Process of Discover Payments

The course of Find installments ordinarily includes three phases:

A. Approval Stage: Starting the transaction:

The customer uses their Discover credit card or bank account to start a payment transaction.

Correspondence with the responsible bank: The vendor’s installment handling framework speaks with the responsible bank (Find) to check the client’s record data and approve the exchange.

B. Clearing stage check techniques:

The exchange subtleties are confirmed for precision, and safety efforts are taken to guarantee the exchange is genuine.

Steering to the proper organization: The exchange is directed to the suitable installment network for additional handling and directing to the client’s responsible bank.

C. Settlement stage money moves from the customer’s account to the merchant’s account once the transaction has been verified and approved.

Affirmation of exchange finish: Both the client and the vendor get affirmation that the exchange has been effectively finished, and the installment interaction is concluded.

These stages guarantee that Find installments are handled safely and proficiently, from commencement to settlement.

Factors Influencing Discover Payment Processing Online Time

Factors affecting Find installment handling opportunities can be arranged into three fundamental regions:

A. Market Factors Category of merchant:

The kind of merchant can affect how long it takes to process a transaction because some industries may have specific rules or requirements that affect how transactions are processed. The terms of the merchant agreement with Discover can also affect the processing time because different merchants may have different processing priorities or levels of service.

B. Factors Relating to the Customer Card Type and Backer:

The sort of Find Card utilized by the client and the responsible bank can influence handling time, as various card types might have changing check cycles or exchange limits.

Client check processes: The degree of confirmation expected for the client’s character or installment data can affect handling time, as extra check steps might be important for specific exchanges.

C. Organization and Specialized Elements Network Clog:

Elevated degrees of organization traffic or blockage can prompt postpones in exchange handling, particularly during top hours or times of high exchange volume.

Framework support and updates: Booked upkeep or framework redesigns by Find or the dealer’s installment handling framework can briefly upset exchange handling and lead to delays.

Average Timeframes for Discover Payment Processing

Normal time periods for Find installment handling can vary contingent upon different variables; however, here are a few run-of-the-mill situations:

A. Common turnaround times in a similar work day:

Many Find installments are handled and finished within a similar work day, particularly for exchanges started during ordinary business hours and with negligible confirmation prerequisites.

1-3 work days: Some Find installments might take 1 to 3 work days to finish, especially for exchanges that require extra check or approval steps.

B. Exemptions and Postponements Weekends and holidays: Because banks and payment networks may have fewer employees or operate on limited schedules on weekends and holidays, processing of payments may be delayed.

Unexpected specialized issues: Sporadically, unanticipated specialized issues or framework blackouts can upset installment handling and lead to postponements in exchange culmination. In such cases, handling times might be stretched out until the specialized issues are settled.

Optimizing Discover Payment Speed

To upgrade Find installment speed, the two traders and clients can make explicit moves:

A. Strategies for Businesses Using Facilitated Handling Administrations:

Shippers can decide on sped up handling administrations presented by installment processors or banks, which might focus on exchanges for speedier handling and settlement. Putting in place effective checkout systems Merchants can speed up the checkout process by putting in place effective payment systems that reduce the number of steps or delays that aren’t necessary. This makes it easier and faster for customers to pay.

B. Client Activities Confirming installment data:

Clients can guarantee that their installment data, for example, card subtleties or charging addresses, is precise and cutting-edge to stay away from any deferrals or dismissals during the installment cycle. Picking fitting installment techniques: Clients can pick installment strategies that offer quicker handling times, for example, utilizing Find cards with contactless installment highlights or computerized wallets, which can assist the exchange interaction compared with customary card swiping or manual passage.

By executing these procedures, the two shippers and clients can help streamline installment speed, resulting in faster exchange handling and further developing installment productivity.

Tracking Discover Payments

To follow Find installments, shippers and clients can use different instruments and correspondence channels:

A. Checking instruments and assets Online vendor entrances:

Shippers can utilize online trader gateways given by installment processors or banks to follow installments, view exchange history, and screen installment status progressively.

Portable applications: The two dealers and clients can utilize versatile applications given by installment processors or banks to follow installments in a hurry, get cautions, and access exchange subtleties from their cell phones or tablets.

B. Channels of communication Client Care Administrations: Shippers and clients can contact Find’s client assistance administrations for help with following installments, settling issues, or getting reports on installment status.

Notifications via email and SMS: Discover lets merchants and customers sign up to receive notifications via email or SMS about payment activity, transaction status updates, or any payment-related issues or concerns.

Merchants and customers can effectively track Discover payments and remain informed by utilizing these monitoring tools and communication channels, ensuring transparency and facilitating prompt resolution of any payment-related issues.

Understanding the Perplexity of Discover Payments

Definition of Perplexity in Online Transactions

Perplexity, within the realm of online transactions, denotes the intricate and bewildering experience users may encounter during the payment process. Discover endeavors to assuage perplexity by furnishing user-friendly interfaces and lucid instructions.

Factors Contributing to Perplexity

The tapestry of perplexity is woven with multiple threads, including ambiguous instructions, intricate payment interfaces, and unexpected errors. Attending to these factors elevates the overall user experience.

Mitigating Perplexity for Smoother Transactions

Discover remains steadfast in its commitment to refining systems and interfaces to diminish perplexity. Users can proactively engage in the process by meticulously reading payment instructions and seeking assistance from customer support when needed.

The Impact of Burstiness on Payment Processing

Definition of Burstiness in the Context of Online Payments

Burstiness characterizes the sporadic surges in transaction volume, resulting in heightened activity within a concise timeframe. Discover, akin to other credit card providers, grapples with burstiness, especially during peak shopping seasons or promotional events.

Instances of Burstiness in Discover Transactions

Discover encounters burstiness during sales, promotions, and other periods of heightened activity. This phenomenon may induce temporary delays in processing as the system copes with the augmented volume of transactions.

Strategies to Handle Burstiness Effectively

Effectively managing burstiness necessitates the deployment of advanced transaction processing systems. Discover diligently monitors and adjusts its infrastructure to navigate these periods adeptly. Users, too, can benefit from an understanding of potential burstiness windows and plan their transactions accordingly.

Balancing Specificity and Context in Discover Payments

Importance of Specific Information in Transactions

Offering specific information in payment-related content assumes critical importance for user comprehension. Details regarding payment methods, processing times, and potential issues collectively contribute to a comprehensive user experience.

Maintaining Context for User Comprehension

While specificity remains imperative, preserving context ensures users grasp the broader narrative. Contextual information facilitates users in connecting individual details to the overarching payment process.

Examples of Balancing Specificity and Context

Consider elucidating the steps of initiating an online payment (specificity) while concurrently emphasizing the overall security of the Discover payment system (context). This approach fosters a well-rounded understanding for users.

Writing Content for High Engagement

Utilizing a Conversational Writing Style

Engaging content is a product of a conversational writing style. Readers establish stronger connections with content that mimics a conversation, rendering information more accessible and enjoyable.

Incorporating Personal Pronouns for Connection

The integration of personal pronouns, such as “you” and “we,” cultivates a sense of connection between the content and the reader. This fosters a friendly and relatable tone, enriching the overall reading experience.

Keeping Content Brief and Active

In the era of information saturation, brevity and activeness are paramount. Readers value concise, to-the-point information that sustains their interest throughout the narrative.

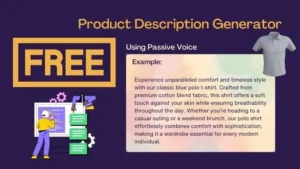

Active Voice in Discover Payment Content

Definition of Active Voice

Active voice accentuates the subject performing the action, crafting direct and impactful sentences. In payment content, active voice contributes to clarity and immediacy.

Advantages of Using Active Voice in Writing

Deploying active voice in Discover payment content ensures information is presented straightforwardly. This clarity aids users in comprehending payment processes without undue confusion.

Examples of Active Voice in Discover Payment Content

Rather than stating, “Delays may be experienced during peak times,” active voice unequivocally asserts, “Peak times may cause delays in processing.”

Rhetorical Questions for Reader Engagement

Purpose of Rhetorical Questions in Content

Rhetorical questions beckon readers to ponder and reflect, enriching engagement. Intertwining relevant questions regarding Discover payments encourages readers to contemplate their experiences and concerns.

Examples of Rhetorical Questions Related to Discover Payments

“How often do you find yourself contemplating the security of your online payments? Discover guarantees robust security measures, but have you explored them?”

Encouraging Reader Interaction Through Questions

Readers exhibit a proclivity to engage when confronted with questions. Encouraging comments and discussions elevates the overall user experience and bequeaths valuable feedback.

Real-Life Scenarios and Case Studies

A. Examples of overcoming adversity in quick installment handling:

Contextual analysis: online retailer An internet-based retailer carried out productive checkout frameworks and used assisted handling administrations presented by their installment processor. Subsequently, they encountered fast installment handling times, with most of the Find installments being finished inside a similar work day. Subsequently, the retailer had the option to offer clients a consistent and helpful shopping experience, which prompted higher transformation rates and consumer loyalty.

Contextual analysis: specialist organization A specialist co-op incorporated versatile installment arrangements into their business tasks, permitting clients to make Find installments utilizing computerized wallets or contactless installment strategies. The service provider streamlined their payment processes and cut down on processing times by providing these convenient payment options. Accordingly, they had the option to convey quicker administration conveyance and further develop a large client experience, prompting positive audits and expanding recurrent business.

B. Problems encountered and solutions implemented:

Challenge: High Exchange Volume A vendor experienced delays in Find installment handling during top times of high exchange volume, prompting disappointed clients and an expected loss of deals.

Arrangement: The dealer updated their installment handling framework to deal with bigger exchange volumes all the more productively and carried out load adjusting procedures to circulate approaching exchanges uniformly across numerous servers. This lightened handling bottlenecks and guaranteed smoother installment handling, in any event, during top times of movement.

Challenge: Specialized Issues Due to technical issues with the merchant’s payment system, a customer’s Discover payment was unable to be processed.

Solution: The merchant promptly notified the Discover customer support team, which looked into the problem and promptly helped fix the technical issues. Furthermore, the trader carried out customary framework support and checking methodology to proactively recognize and resolve any possible specialized issues, guaranteeing smoother installment handling and limiting disturbances for clients later on.

These genuine situations show the significance of proficient installment handling and the different methodologies that shippers and clients can carry out to defeat difficulties and improve Find installment encounters.

Analogies and Metaphors in Discover Payment Content

Enhancing Understanding with Analogies

Analogies simplify complex concepts by drawing parallels to familiar scenarios. Infusing analogies into payment content aids in user comprehension.

Using Metaphors to Explain Complex Concepts

Metaphors render abstract concepts tangible. Applying metaphors to facets of Discover payment processes elucidates intricate details for users.

Examples of Analogies and Metaphors in Payment Content

“Imagine burstiness as akin to a sudden influx of customers in a physical store during a sale. The system necessitates a moment to process the escalated traffic seamlessly.”

Crafting a Conclusion

Summarizing Key Points

In conclusion, a comprehensive understanding of how long it takes for a Discover payment to transpire online involves considering an array of factors. From immediate payment options to potential delays and the ramifications of burstiness, users armed with this knowledge can adeptly navigate the payment process.

Encouraging Readers to Apply Knowledge

Equipped with insights into Discover payment processing, readers are urged to implement this knowledge in their online transactions. Making informed choices and apprehending the dynamics of payment processing contributes to a seamlessly orchestrated financial experience.

Transition to the FAQs Section

To address any lingering queries or concerns, let’s delve into some frequently asked questions about Discover payment processing.

FAQs on Discover Payment Processing

1. How long does it take for a Discover payment to go through online?

The timeframe varies based on the selected payment method. Immediate options exist, while standard processing may necessitate several business days.

2. Are there any instant payment options for Discover?

Absolutely, Discover extends immediate payment options through its official website and mobile app.

3. What factors can cause delays in Discover payments?

External factors, such as bank processing times, holidays, or technical issues, can contribute to delays.

4. How can users minimize perplexity in online transactions?

Thoroughly reading payment instructions, utilizing user-friendly interfaces, and reaching out to customer support when needed can mitigate perplexity.

5. Is burstiness a common issue in Discover payment processing?

Burstiness may transpire, especially during peak shopping seasons or promotional events. Discover employs strategies to manage and mitigate burstiness effectively.